Contents:

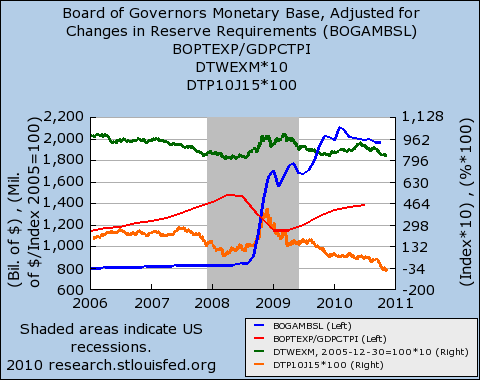

You just need to input the necessary values and the calculator generates the results immediately. As an investor, it is important to know how well your investments have performed on an average year on year. This graph shows the YOY interest earned on your investment based on the maturity value and duration of the investment.

It is called CMGR, which evaluates the average monthly growth. It is like CAGR, which evaluates the average annual growth rate. All you must do is replace the number of years with the number of months.. CAGR is an important tool which is used to measure the performance or profitability of any investment. As it considers the period of investment, it helps in providing a better understanding of the performance of the investment or the company in comparison to another. This helps in making accurate investment decisions which can result in higher profitability for the investor.

But don’t worry for that we have CAGR Calculator that helps us in calculating our return on investments annually. But before calculating that, you should know basics about this concept. And, of course, as with any other financial tool, you should also take the time to consider the risk and return of a particular investment before investing. CAGR is not effective for calculating returns from investments where the investing is periodic, as in the case of systematic investment plans or SIPs.

Difference between Simple and Compound Annual Growth Rate

As such, one may make use of the CAGR formula and review the fund performance in a better manner. CAGR is a rate which shows how much a person’s investment grows over a specific period. In other words, it is the average returns an investor has earned on the investments after a given interval say one year.

Investors are requested to note that Stock broker is permitted to receive/pay money from/to investor through designated bank accounts only named as client bank accounts. Stock broker is also required to disclose these client bank accounts to Stock Exchange. Hence, you are requested to use following client bank accounts only for the purpose of dealings in your trading account with us. The details of these client bank accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stock Broker”.

Global Remote Weapon Station Market Set to Achieve a Valuation of … – GlobeNewswire

Global Remote Weapon Station Market Set to Achieve a Valuation of ….

Posted: Tue, 28 Mar 2023 13:57:32 GMT [source]

This formula is relatively simple and assumes that any matter or income generated has been reinvested through interest or dividends and compounded in the investment in financial stocks. CAGR is a useful measure of growth over multiple time periods. The Compound Annual Growth Rate is useful for traders and investors as it accurately measures their investments’ rise and fall over a period of time. However, you must understand that CAGR does not indicate accurate return, and it is just a representative number as the profits may get reinvested at the end of each year. As per this formula, for calculating the CAGR of any investment, the end value of the investment along with the beginning value and the period of investment are considered.

Example for the calculation of CAGR

cagr to annual growth rate return simply tells the total growth in the investment value and ignores the time period. Whereas, CAGR return provide the average yearly growth rate in the investment. Absolute return is useful if the time period is less than a year. CAGR is a well-accepted measure of mutual fund performance, widely used by mutual fund houses as well for investment periods of more than one year.

- It is the cumulative measure of the performance of a product over a period of time.

- Assume that you purchased some units of an equity fund earlier and that their value has since increased.

- CAGR values can also be used to calculate absolute returns which is another measure of evaluating the investments.

- Unlike the simple growth rate, the compound annual growth rate enables you to compare investments with different time horizons.

- Therefore, CAGR is a representative number, not an accurate return.

- Email and mobile number is mandatory and you must provide the same to your broker for updation in Exchange records.

The formula for calculating CMGR is the same; simply replace the number of years with months. CAGR formula takes into account the impact of time and compounding. As an investor, you can decide how much to invest now to achieve a specific investment goal over time.

How to use the 5paisa CAGR Calculator?

Most https://1investing.in/ing methods, like mutual funds, use compound interest to calculate returns. Therefore, CAGR would be an appropriate means of calculating the quality of the investment. What the investment’s time horizon is doesn’t matter when calculating CAGR. Notably, the compounded annual growth rate allows you to evaluate investments over a range of time horizons, in contrast to the simple growth rate. CAGR refers to Compounded Annual Growth Rate, which is a measure of how much an investment has grown over a period of time.

Vasopressin Market is expected to generate a revenue of US … – Digital Journal

Vasopressin Market is expected to generate a revenue of US ….

Posted: Tue, 28 Mar 2023 08:19:50 GMT [source]

At times it rises, at times it falls, perhaps even generates negative returns. CAGR lets you know how much your investment grew over a period of several years. CAGR indicates the compounded returns you earn on an annual basis irrespective of the annual performance of your investment. Basically, CAGR tells us how much we have earned on our investments annually during a particular period. This helps us to determine whether our investment returns rise or fall during a particular period. Are you wondering that this might involve to some tough mathematical formula?

Compound Annual Growth Rate (cagr)

Over long investment tenures compounding has the power of multiplying your investments. For example, if you invested Rs 1 lakh in a mutual fund scheme which gave compounded returns of 10%, the value of your investment after 20 years will be Rs 6.7 lakhs. You can see that your investment multiplied nearly 7 times due to the compounding effect. Absolute return is the total return from the date of investment till the current date. The absolute return shows the total increase or decrease in the investment over a period of time in percentage terms. CAGR shows by which rate the investment has grown annually over a period of more than 1 year.

Mutual funds are going all out to get investors to put money in their debt schemes before March 31, when the tax advantage these products enjoy will come to an end. You may consider an absolute return as the increase or decrease of an investment over a given time period, expressed in percentage terms. You may use the Compound Annual Growth Rate or CAGR to determine the performance of your stock investments over a set period of time.

A) Divide the investment’s value at the end of a period by the one at the start. Increase the result to the power of one divided by the tenure of the investment in years. We do not sell or rent your contact information to third parties. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month. The formula of calculating CMGR is the same; you need to replace the number of years with months, that is 12.

When you invest in any investment such as an equity mutual fund where returns are not assured, you want to know how much is the return generated? Also, some of your investments are in lumpsum while you may also have a SIP in mutual funds. CAGR is calculated by looking at an asset’s opening and closing values over some time to assess performance or appreciation.

For a Company with a track record of over five years, you may consider a CAGR of 10%-20% to be good for sales. You then fill the final value of the investment and the number of years of the investment. Shape your investment journey with 25+ premium courses, 15+ stock recommendations and a premium subscription of Ticker Plus. If you are looking for a secure investment option with minimal credit risk then Gilt… On clicking on Invest Now, you will be redirected to 3rd Party page/ gateway owned / operated by an independent party i.eSmallcase Technologies Pvt. Ltd. (“Smallcase”) over which UTI Mutual Fund has no control/influence (“3rd Party Gateway”).

You get an idea on how much your stocks have gained or lost each year. To calculate the CAGR in mutual funds using excel sheet, here is an example of CAGR calculation. This means that over the last five years, the total market capitalization has risen at 31.5% per year, while earnings have seen a total year-on-year increase of 22%. The CAGR calculator will give you the rate of return on investment when you enter the three variables above. CAGR is one of the most accurate ways to calculate the return on an investment that rises and falls in value during the investment period.

Further, it can be used to compare the performance of two companies and forecasting their future growth based on their historical data. The Compound Annual Growth Rate is a percentage-based metric used to determine the annual rate of growth of an investment over a period of more than one year. In other words, CAGR allows you to consider the average returns your investment receives over a period of time. The CAGR gives you the average rate of return earned over the period of investment.

- Select or type the duration of the investment figures in the box provided.

- And it’s the same for stocks and bonds and can be applied to a variety of personal finance scenarios.

- Can estimate your average yearly growth through investment over a provided period.

As the second step, you must fetch the NAV of the fund at the beginning of the investment period, or what we call the starting NAV. The securities quoted are exemplary and are not recommendatory. The information mentioned herein above is only for consumption by the client and such material should not be redistributed. The CAGR Ratio compares returns over time to determine which is the better investment. You have the option of choosing the investment with the highest CAGR Ratio. So, before investing, take our Free Investor Personality Test.

A high CAGR is better compared to low CAGR as it indicated better returns on our investment. The more time you’ll save, the more you’ll be able to generate strategies for your business. Therefore, use Khatabook to keep all transaction history handy and manage profit and loss ratio easily. Now keep track of your cash flow and manage your incomes and expenses with ease by using the Khatabook app. Is calculated by multiplying the rate by the number of years it takes for it to reach its highest potential.