Content

Because the same percentage is used in every year while the current book value decreases, the amount of depreciation decreases each year. Even though accumulated depreciation will still depreciation closing entry increase, the amount of accumulated depreciation will decrease each year. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

The income statement summarizes your income, as does income summary. If both summarize your income in the same period, then they must be equal. In this segment, we complete the final steps of the accounting cycle, the closing process.

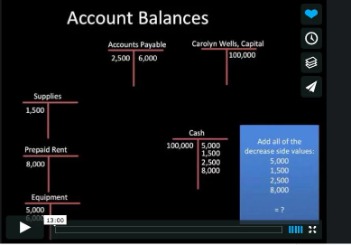

The Accounting Cycle Example

Let’s explore each entry in more detail using Printing Plus’s information fromAnalyzing and Recording TransactionsandThe Adjustment Processas our example. The Printing Plus adjusted trial balance for January 31, 2019, is presented in the following Figure 1.28. The Replacement CostReplacement Cost is the capital amount required to replace the current asset with a similar one at the present market rate. Usually, assets replacement occurs when their repair & maintenance charges surge beyond a reasonable level. Salvage Value Of The AssetSalvage value or scrap value is the estimated value of an asset after its useful life is over.

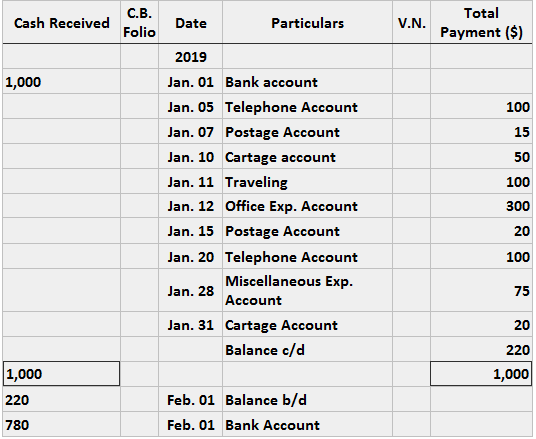

- Closing entries take place at the end of an accounting cycle as a set of journal entries.

- It happens because of the difference in the depreciation method adopted by the market and the company.

- Answer the following questions on closing entries and rate your confidence to check your answer.

- The closing journal entries are prepared after the financial statements and before making the post-closing trial balance.

- Let’s look at another example to illustrate the point.

Whether you maintain the provision for depreciation/accumulated depreciation account determines how to do the journal entry for depreciation. Figure 1.30 Statement of Retained Earnings for Printing Plus. © Rice University OpenStaxCC BY-NC-SA The statement of retained earnings shows the period-ending retained earnings after the closing entries have been posted. When you compare the retained earnings ledger (T-account) to the statement of retained earnings, the figures must match. It is important to understand retained earnings isnotclosed out, it is only updated. Retained Earnings is the only account that appears in the closing entries that does not close.

Determine the Gain or Loss

Because of this, you need to record the depreciation during each period as an expense on the income statement. For example, if your machine depreciates by $1,000 each year, this will be a $1,000 expense on the income statement annually. Company A buys a piece of equipment with a useful life of 10 years for $110,000.

Does Accumulated depreciation go on closing entry?

Accumulated Depreciation which is a balance sheet contra asset account and its balance is not closed at the end of each accounting period. As a result, Accumulated Depreciation is viewed as a permanent account.