Contents:

It is advisable to prescribe the proportion of investments in different securities like government securities 60%, corporate securities 20%, etc. The firm should have a clear mechanism to get the risk of the portfolio and this information should be made available to chief of treasury operations. If the level of operation is very high, it is worth to implement the concepts like Value-at-Risk to avoid major losses on such transactions. Investing short-term surplus in short-term securities has an advantage over other securities because short-term securities will reflect the interest accrued on a day to day basis.

Businesses that have conservative money administration policies are inclined to put money into brief-term marketable securities. They avoid long-time period or riskier securities, similar to stocks and stuck-earnings securities with maturities longer than a yr. Marketable securities are sometimes reported right beneath the cash and cash equivalents account on a company’s balance sheet in the present belongings section.

That is, the most marketable securities examples asset occupies the top place in the list. Current ratio evaluates a company’s ability to meet its short-term obligations typically due within a year. A current ratio lower than the industry average suggests higher risk of default on the part of the company.

Such securities are added to the company’s asset base, normally underneath the path of senior monetary officers or the Board of Directors. For accounting functions , these securities are usually classified as both Marketable securities or Investment securities. Many brief-term investments are sold or converted to money after a interval of solely three-12 months. Here you can find the meaning of What are marketable securities ?

Swaps, futures contracts, and options are examples of derivative securities. The result reveals that the company can successfully meet its immediate liabilities, thus indicating favoured financial health. Next, determine the total current liabilities that your company owns. Evaluate this by calculating the amount of money your company owe and will get this within this year, like accounts payable, fixed debts, wages, and taxes.

It is paramount to understand what assets are to help decipher a company’s standing. The term ‘inventory’ is used to denote raw material, finished products, and other such components that companies hold with a goal for reselling. However, considering inventories under the current assets list can be tricky as few types of inventories may be illiquid, depending on the industry sector of the company.

Fixed assets, long term debt and capital of Nestle as on that date. Thus, this deferred tax asset gets reversed over a period of time. It gets reversed at a time when the expense is deducted for tax purposes.

Types of Marketable Securities

You can use this information for the analysis of different domains. It is because you can have more cash for day-to-day business operations. Over accumulation, this will prove to be of higher value, as is the time value of capital. Whereas deficiency of a resource like inventory can disrupt the business procedures.

The short term investments in case of Nestle stood at Rs 19,251.30 million for the year ended December 31, 2018. Thus, Nestle keeps a check on its current assets to get rid of the liquidity risk. It ensures that it has sufficient liquidity to meet its operational needs.

Recent Terms

Quick ratio is a more cautious approach towards understanding the short-term solvency of a company. It includes only the quick assets which are the more liquid assets of the company. Accounts receivables are the amounts that a company’s customers owe to it for the goods and services supplied by the company on credit. The accounts receivables are presented in the balance sheet at net realizable value. These amounts are determined after considering the bad debt expense.

Non-Marketable Security Explained – Nasdaq

Non-Marketable Security Explained.

Posted: Tue, 06 Sep 2022 07:00:00 GMT [source]

In fact, the survival of a company can depend on the availability of cash to meet financial obligations on time. Marketable securities consist of short-term investments a firm makes with its temporarily idle cash. Marketable securities can be sold quickly and converted into cash when needed. Unlike cash, however, marketable securities provide a firm with interest income. First, collect all the assets that can be transformed into cash in a time frame of one year or less from the company’s balance sheet. In simple words, it includes cash, cash equivalents, inventory, prepaid expenses, accounts receivables, marketable securities, and other liquid assets.

Role of Assets in estimating business value:

Available for sale securities – This category of security involves those marketable securities which are neither debt nor securities. Stock of companies as well as bonds of firm and government entities are also part of these securities, if they are marketable that is, they can be readily sold. Commercial Paper – A short term interest bearing promissory notes, mainly issued by large organisations having high credit ratings. They issue it to fulfill their cash requirements for the shortest time.

Varonis Systems (VRNS) Q1 2023 Earnings Call Transcript – The Motley Fool

Varonis Systems (VRNS) Q1 2023 Earnings Call Transcript.

Posted: Tue, 02 May 2023 02:00:25 GMT [source]

It is reasonably expected to be converted into cash or cash equivalents within a year. They are advance payments for goods and services that a business or a firm will utilise/receive in the future. For instance, any payment made to insurance companies or contractors before its due can be considered a prepaid or advance expense. However, they must be reviewed before being added to a company’s balance sheet. Sometimes an inventory or goods may be illiquid or cannot be easily converted to cash.

Open Demat Account &

For laymen, https://1investing.in/ are financial assets of monetary value that investors use to invest in a company, while companies use them to raise capital. In India, securities are defined under the Securities Contracts Act of 1956. Under Section 2 , securities include “shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporates. Companies Act 2013 also refers to the exact definition, and under Section 2 , securities have the same meaning as defined above.

1 Valuable Lesson the SVB Collapse Taught Growth Investors – The Motley Fool

1 Valuable Lesson the SVB Collapse Taught Growth Investors.

Posted: Thu, 06 Apr 2023 07:00:00 GMT [source]

A company’s current liabilities include its obligations or debts, which must be cleared within the year. The quick ratio of the business is 1.07, which indicates that the owner can pay off all the current liabilities with the liquid assets at the disposal and still be left with a few assets. Thus, the classification of assets is essential to determine a company’s liquidity position, solvency, and risk.

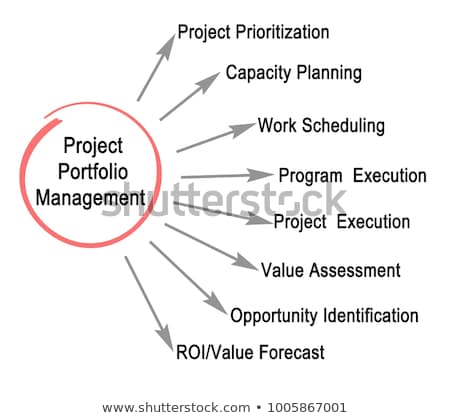

Provide a guideline to develop strategies in the management of securities. • Provide a guideline to develop strategies in the management of securities. None of the employees works at the office; all work from their homes. Revenues or gains are taxable before they are shown in the income statement. Also, an asset for one company might not be an asset for another.

Importance of assets

Classification into current assets and fixed assets helps in planning for working capital requirements and also in knowing the long-term financial position of a company. If a firm has a large amount of money tied up in illiquid assets like land, buildings, etc., it may find it difficult to meet its short-term liabilities and financial obligations. Marketable securities are securities or debts that are to be sold or redeemed within a year.

Preferred stock also carries a fixed cash dividend to the common shareholders. Like debt, preferred stock is often systematically retired through a sinking fund. It also does not represent true residual ownership because preferred shareholders usually do not participate in earnings growth by receiving higher dividends, as common shareholders do. The task of financial managers, who become involved with marketable securities either full-time or part-time, consists of three issues. First, managers must understand the detailed characteristics of different short-term investment opportunities.

They can call the local retail partners to liquidate these assets. Your account will automatically be charged on a monthly basis until you cancel. There is no limit on the number of subscriptions ordered under this offer. This offer cannot be combined with any other QuickBooks Online promotion or offers. The prepaid expenses form a part of Other Current Assets as per the notes to financial statements given in Nestle’s annual report.

- “Liquid” means the safety can easily be converted into cash on quick notice by the business that holds it.

- Consider the following example for calculating the current assets of a corporation called XYZ Ltd.

- Here are some examples that will help you understand the process better.

Shri Baruas yet another objection is that the Appellant had not contested the finding of fact made by the Adjudicating Officer in its pleading is contrary to the facts. In fairness to the parties, it has to be stated that they did not object to the opposite party producing letters/notices etc. relied on them, at the time of argument, though they were not filed earlier with the appeal/reply. Therefore I have taken on record the letters/notices, etc., referred to in their submissions.

It is quiet possible to invest in long-term securities such as 20-year government bond and sell it after a week, which is essentially a short-term investment in a long-term bond. Similarly investment can be made for a short period in equity or derivative securities. An understanding of different markets is important for the financial managers in this context.

In terms of section 12 of the SEBI Act, certificate of registration is required to be obtained from SEBI to carry on the business of mutual funds. Conditions for grant or renewal of certificate for the purpose of section 12 of the Act has been stipulated in rule 4. The common stockholders are the risk takers; they own a portion of the firm that is not guaranteed, and they are last in line with claims on the company’s assets in the event of a bankruptcy. In return for taking this risk, they share in the growth of the firm because the growth in the value of the company accrues to the common shareholders.

To calculate the shares of a company, you need to divide the number of shares owned by the company by the total number of shares of the company and multiply by 100. The advantage of investing in equity securities is virtually no risk of default for the company. Their profit or loss corresponds to the ownership they exercise in the company. No, property, plants and equipment, also known as PP&E which does not fall under current assets. Current assets are the assets providing benefit within one year. Due to this, they are considered fixed assets which makes them illiquid as they won’t be convertible to cash anymore.